Content

Content

Draft National Infrastructure Plan

7.8. Public administration and safety | Ngā whakahaere me te haumaru tūmatanui

7.8.1. Institutional structure

Service delivery responsibilities

- The public administration and safety sector is a broad category that includes central and local government administration buildings, courthouses, prisons, and defence infrastructure.

- Central government provides justice and corrections services and supporting infrastructure. Service and infrastructure providers include the New Zealand Police (police buildings), Corrections (correctional facilities), and Ministry of Justice (courts).

- Central government also provides defence services and supporting infrastructure. Decisions are jointly made by the New Zealand Defence Force (NZDF) and Ministry of Defence. NZDF leads infrastructure and ICT delivery.

- Individual central government departments are responsible for procuring their administration buildings, with some centralised support, these are largely leased. For local government, this is the responsibility of the council, to the extent they own the buildings they use (as opposed to leasing office space).

Governance and oversight

- Relevant ministries are responsible for policy and planning. Oversight tends to operate via budget and performance targets to improve productivity and cost efficiencies.

7.8.2. Paying for investment

- Funding of central government administration buildings, justice buildings, corrections, emergency services and defence comes from general taxation. The Ministry of Justice collects minimal revenue from filing fees, largely used for operating expenditure.

- Funding for local government administration buildings is funded through rates.

7.8.3. Historical investment drivers

- Investment in public administration and safety infrastructure is driven by several different factors.

- Public administration buildings will have standard renewal requirements. They may also require investment to become more resilient to natural hazards or to bring them up to modern standards.

- Justice and corrections infrastructure are tied to population-driven demands, as a larger population will require greater capacity to process criminals. Policy decisions around sentencing and managing of court backlogs influence perceived requirements for prison capacity.

- Defence investment is a function of foreign policy, geopolitical risks, and renewals of existing assets deemed important for New Zealand’s defence capability. Defence capability also plays an important role in responses to natural hazard events.

7.8.4. Community perceptions and expectations

- It is difficult to separate the public’s views on infrastructure aspects of public administration, safety, and defence relative to the services they provide.

- For instance, a 2016 survey showed that 62% of New Zealanders think we should spend more or much more on police and law enforcement. However, it’s unclear whether this relates specifically to physical infrastructure as opposed to the overall law enforcement system.

- New Zealanders’ views about whether to spend more or less on justice and defence infrastructure are mixed, and vary over time. This may make planning infrastructure investments, which require a degree of consistency in public agreement, challenging.

- For example, a 2025 survey showed that 50% of New Zealanders agreed we should spend more on defence. However, in a different 2016 survey, only 20% said we should spend more or much more on defence.

7.8.5. Current state of network

- Public administration and safety is a large and diverse sector. As of 2022, it was composed of over $30 billion worth of assets (excluding land). Some sectors within it are significant; defence and corrections infrastructure are worth over $9 billion and $4 billion respectively (both of which are bigger networks by value than the whole rail network).

- These networks include several different types of assets, including specialised buildings (courts, police stations, and prisons in justice; medical facilities, family housing, and barracks in defence estate), airport and port infrastructure (in the defence estate), land transport and water infrastructure (for both justice and defence), supporting telecommunications and ICT assets, and other specialised assets (e.g., weapons ranges).

- To date, no international benchmarking of public administration and safety networks has been completed, although this is identified as an area for future work. This is due to the lack of consistent international comparison data on infrastructure in this sector, but also because this sector includes different and distinct types of infrastructure (administration buildings, justice buildings, prisons, and defence infrastructure).

7.8.6. Forward guidance for capital investment demand

|

Public administration and safety |

2025–2035 |

2035–2045 |

2045–2055 |

2010-2022 historical average |

|

Average annual spending 2023 NZD) |

$3.3 billion |

$3.8 billion |

$4.3 billion |

$2.8 billion |

|

Percent of GDP |

0.8% |

0.8% |

0.7% |

0.2% |

This table provides further detail on forward guidance summarised in Section 3. Further information on this analysis and the underlying modelling assumptions is provided in a supporting technical report.[119]

- Our outlook for this sector is largely stable, with investment levels settling at close to the long-term trend. However, demand for justice, corrections, and defence is hard to predict. Policy and geopolitical factors play an outsized role in determining investment needs. As such, our investment outlook for this sector is subject to considerable uncertainty.

- Over the next 10 to 20 years, we expect a rising focus on renewal and replacement of infrastructure built between the 1950s to the 2000s. There is a need for significant asset renewal and maintenance across justice infrastructure and defence estate, to maintain the condition of existing infrastructure and replace end-of-life assets.

- Demand for new infrastructure associated with population and income growth is expected to be relatively modest. The impact of policy and geopolitical factors is harder to forecast.

7.8.7. Current investment intentions

- We are currently working to align definitions of the sector within our Pipeline, the Treasury’s Investment Intentions data, and our own investment outlook.

- Here, we present information for justice, corrections, and emergency services, but this excludes public administration buildings. We estimate that the value of these assets equates to roughly a third of total asset values within Public Administration and Safety.

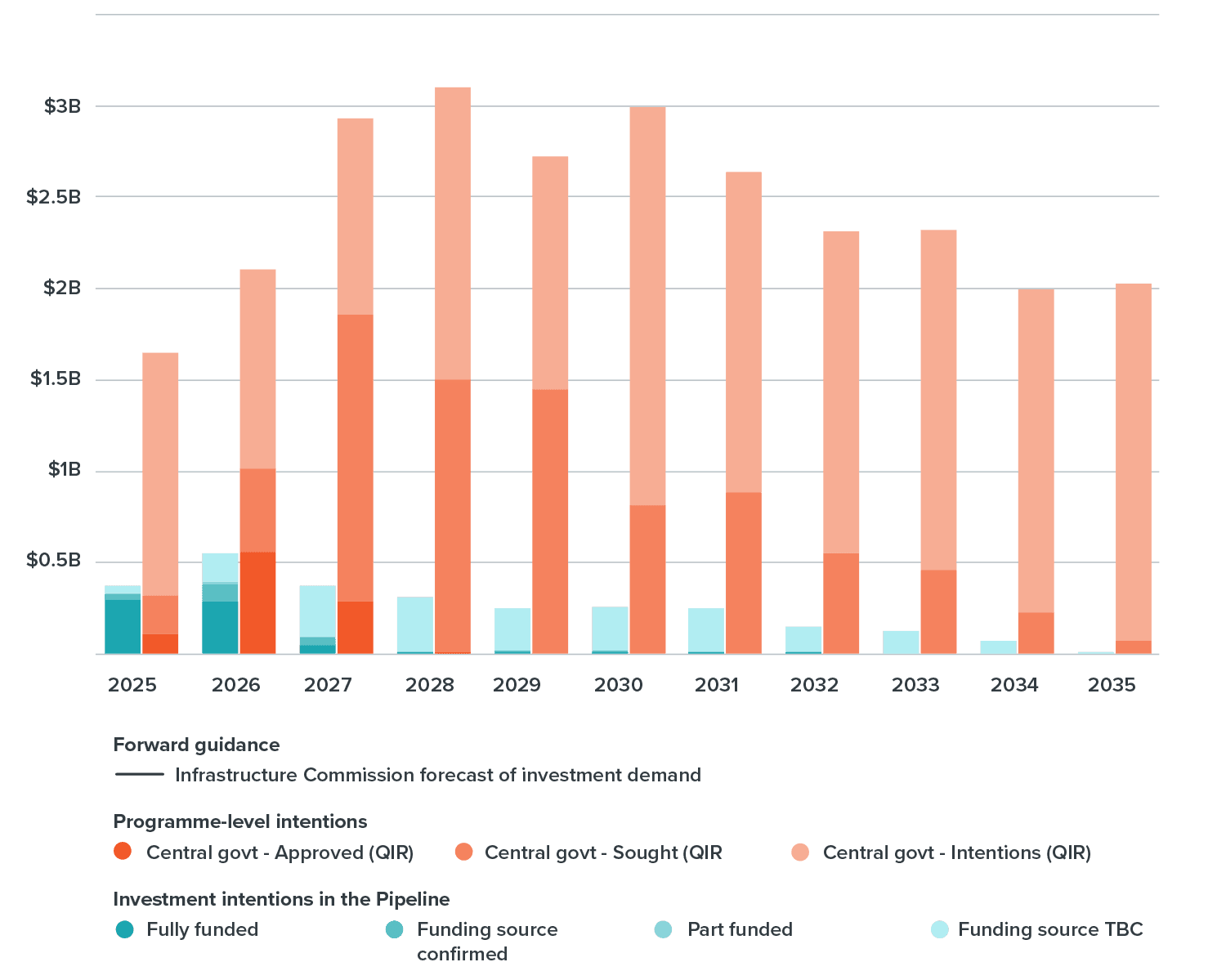

- The following chart shows projected spending to deliver initiatives in planning and delivery in the Pipeline (blue bars) and programme-level intentions in central government’s reporting to the Treasury’s Investment Management System (orange bars) over the 2025–2035 period.

- Investment intentions and funding sought outweighs approved and funded projects.

This chart compares two different measures of future investment intentions. The blue bars show project-level investment intentions from the National Infrastructure Plan, distinguishing based on funding status. The orange bars show an alternative measure of investment intentions based on programme-level data from central government’s reporting to the Treasury’s Investment Management System, again distinguishing by funding status. It does not show a comparison with the Commission’s forward guidance on investment demand as work is ongoing to working to align data definitions.

This chart compares two different measures of future investment intentions. The blue bars show project-level investment intentions from the National Infrastructure Plan, distinguishing based on funding status. The orange bars show an alternative measure of investment intentions based on programme-level data from central government’s reporting to the Treasury’s Investment Management System, again distinguishing by funding status. It does not show a comparison with the Commission’s forward guidance on investment demand as work is ongoing to working to align data definitions.

7.8.8. Key issues and opportunities

- Asset management: According to the Commission’s report ‘Taking care of tomorrow today: Asset management state of play’, defence asset management practices appear reasonably well-developed, while justice and public safety had more room for improvement. Development of long-term asset management and investment plans is a key opportunity for the sector.

- Transparency and accountability: Central government, as the funder and oversight role in this sector, has an opportunity to provide more transparency around its maintenance and renewal requirements.

- Project appraisal and evaluation: Central government evaluation of projects being submitted for budgetary funding could be improved.