Content

Content

Draft National Infrastructure Plan

7.7. Hospitals | Ngā Hōhipera

7.7.1. Institutional structure

Service delivery responsibilities

- The hospital sector includes both public and private hospitals. In addition, the broader healthcare sector includes primary healthcare services (such as general practitioners) and secondary healthcare services (such as community health providers and specialist services), which are not included in our infrastructure demand analysis.

- New Zealand has recently adopted a model with a single centralised Crown entity (Health New Zealand) that provides public hospital services. Public hospital assets are owned, funded, and managed through the single entity structure.

- In addition, private hospitals are operated by various commercial entities.

Governance and oversight

- The Ministry of Health monitors the performance of Health New Zealand. It is responsible for health policy and planning.

- Oversight tends to operate via budget and performance targets to improve productivity and cost efficiencies.

7.7.2. Paying for investment

Public funding

- The New Zealand government funds around 80% of the cost of health and disability services through taxation. Other costs are met by users. This means that eligible residents can access a wide range of services, including inpatient and outpatient care, mental health services, and long-term care, often free or at a low cost.

- The New Zealand government sets an annual budget for health spending, with Health New Zealand then allocating funding to various services. The central government owned Accident Compensation Corporation (ACC) funds healthcare for accident recovery through an insurance model.

- While most healthcare is publicly funded, a private healthcare system including private hospitals, specialist clinics, and private insurance options exists in parallel. Some healthcare services are also funded by voluntary organisations and private donations, supplementing public funding.

7.7.3. Historical investment drivers

- Investment in health infrastructure is driven by population and demographics, income and standards growth, and changes in medical technologies and clinical services delivery methods.

- Investment in health infrastructure as a share of GDP peaked in the period between 1960 and 1980. At first, much of this investment was likely in response to population growth, as hospital capacity increased markedly over the period. Over time, expenditure appeared to shift towards improving the quality of existing facilities, which may be a response to medical innovations.

- Health infrastructure is part of a system of inputs, along with doctors, nurses, medications, and delivery systems, that lead to better health outcomes. Often, hospital capacity and operational spending is needed to deliver health services, but at times other spending can substitute for hospital capacity. For instance, more emphasis on primary care may reduce the need for hospitals.

7.7.4. Community perceptions and expectations

- The health system (healthcare and health infrastructure) is a consistent concern and enduring top priority for New Zealanders, across a range of surveys and over time.

- While overall, New Zealanders would prefer to spend more efficiently, rather than more, on public services and infrastructure, health is perhaps the main exception. Most New Zealanders support spending more to improve health services.

- While most surveys do not speak to the relative importance of healthcare services versus infrastructure, ageing hospital infrastructure was identified as a priority concern in one recent survey.

7.7.5. Current state of network

|

Network |

Investment |

Quantity of infrastructure |

Usage |

Quality |

|

Health |

-24% |

-10% |

-2% |

-13% |

Comparator countries: Australia, Denmark, Iceland, Norway, Sweden, United Kingdom. Similarity based on: Income, population aged 4 and below, and 65 and above, urban population, public coverage of core set of services. Percentage differences from comparator country averages are based on a simple unweighted average of multiple measures for each outcome. Further information on these comparisons is available in a supporting technical report.[117]

- Our benchmarking analysis focused largely on health infrastructure measures, rather than overall health system measures. Across most metrics we gathered, New Zealand falls towards the lower end of its comparator countries.

- New Zealand’s infrastructure spending per capita is below average relative to comparator countries.

- New Zealand has a relatively low number of hospital beds, although this may reflect how countries deliver healthcare. We also appear to have comparatively low amounts of some medical equipment, like PET scanners or gamma cameras. Waiting times for elective surgeries, which could reflect infrastructure availability (operating theatres, equipment), are higher than most comparator countries.

- There is some evidence of deteriorating quality of assets. While building envelopes of hospitals are mostly in good to average condition, sitewide infrastructure is in poorer condition, and the average age of hospitals is high compared to the United Kingdom (which was the only comparator country which had comparable hospital age data).

7.7.6. Forward guidance for capital investment demand

|

Hospitals |

2025–2035 |

2035–2045 |

2045–2055 |

2010-2022 historical average |

|

Average annual spending 2023 NZD) |

$1.5 billion |

$1.9 billion |

$2.1 billion |

$0.8 billion |

|

Percent of GDP |

0.4% |

0.4% |

0.4% |

0.2% |

This table provides further detail on forward guidance summarised in Section 3. Further information on this analysis and the underlying modelling assumptions is provided in a supporting technical report.[118] Our investment outlook is primarily focused on hospital infrastructure and fixed assets therein, rather than other infrastructure such as general practitioner offices or community health centres.

- We anticipate a significant uplift in investment to meet growing needs of an ageing population. Barring a change to the delivery of healthcare or major medical innovations, population ageing is expected to put upward pressure on hospital demand.

- Renewals of existing stock built during the boom period will also contribute to rising investment requirements over the next 20 years.

- There is also a need to increase investment to catch up from low levels of investment from the 1990s to the 2010s.

7.7.7. Current investment intentions

- Investment intentions for health infrastructure are based on information available as of 31 March 2025. No information on long-term intentions was submitted to the Treasury in June 2024. Subsequently, Health New Zealand released their Health Infrastructure Plan in April 2025 indicating a need for $20 billion investment in health infrastructure over 10 years.

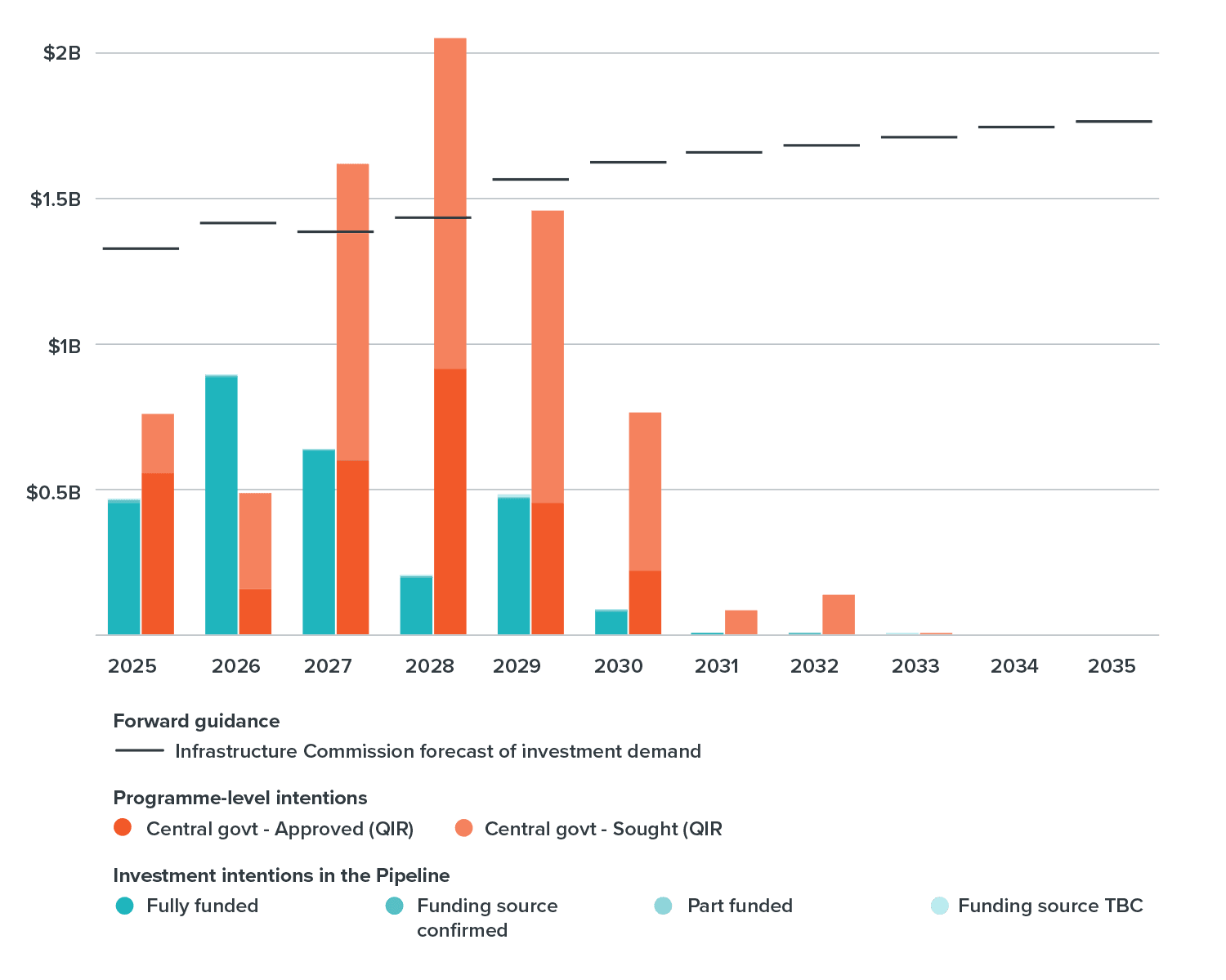

- The following chart shows that projected spending to deliver initiatives in planning and delivery in the Pipeline (blue bars) and programme-level intentions in central government’s reporting to the Treasury’s Investment Management System (orange bars) are lower than the Commission’s investment demand outlook (black lines) over the 2025–2035 period.

- Information in the Pipeline appears focused on fully funded initiatives and does not indicate work in planning. These initiatives account for only 17% of expected investment demand over the period.

This chart compares two different measures of future investment intentions with the Commission’s forward guidance on investment demand. The blue bars show project level investment intentions from the National Infrastructure Plan, distinguishing based on funding status. The orange bars show an alternative measure of investment intentions based on central government’s reporting to the Treasury’s Investment Management System, again distinguishing by funding status. The black lines show the Commission’s forward guidance on investment demand.

7.7.8. Key issues and opportunities

- Asset management and investment planning: As the main funder and provider for health, central government has an opportunity to improve the quality of asset management in the sector. This will be critical as needs in the sector grow. Procurement and financing options that embed asset management (like PPPs or structured leases) may be an opportunity to improve asset management for new hospitals.

- Coordination: Given the growing needs in the sector, there is a requirement for investment plans initiated by Health New Zealand to be connected to wider budget processes managed by the Treasury.

- Project appraisal: As many hospitals prepare for renewal, ensuring their replacements are right-sized and not overdesigned will help to manage pressure on funding availability.

- Efficient regulation and funding: Medical innovation introduces considerable uncertainty in health investment. Historically, these innovations have reduced the need for health infrastructure (such as breakthrough medications), but also increased them (scanning machines). Regulation and funding needs to be able to adapt.

- Equity: Access to equitable health services is a top priority for New Zealanders, yet there are inequities in accessing health infrastructure between different locations and for different groups.